Are you an entrepreneur seeking to establish a company in Estonia? Wondering about the costs involved and the benefits it offers?

Estonia’s streamlined incorporation process, favorable business environment, and advanced digital infrastructure make it an attractive destination for startups and established businesses. But what about the costs? We’ll discuss the importance of considering expenses when setting up your business in Estonia, ensuring that you have a clear understanding of what to expect.

So, if you’re ready to embark on your entrepreneurial journey and want detailed information on Estonia company formation cost, advantages, application process, and more, buckle up! Let’s dive in!

How to Register a Company in ESTONIA?

Register a company by e-Residency Card

| Step | Process |

| 1. 🌐 | Apply for e-Residency: – Visit the official e-Residency website. – Complete the online application and pay the necessary fee. – Wait for the application to be processed, typically taking a few weeks. |

| 2. 📧 | Receive e-Residency Card: – Once approved, receive an email notification. – Collect your e-Residency card from the Estonian Embassy or a specified pickup location. |

| 3. 🏷️ | Choose a Unique Company Name: – Decide on a unique name for your company adhering to Estonian business name regulations. |

| 4. 📄 | Prepare Documentation: – Gather identification documents for all shareholders and directors. – Draft articles of association outlining your business’s purpose and structure. |

| 5. 🖥️ | Register Online: – Access the Estonian Commercial Register online. – Fill in required information, including the chosen company name, shareholder details, and articles of association. – Pay the registration fee electronically. |

| 6. 📤 | Submit Documents: – If required, upload scanned copies of identification documents and other necessary paperwork. – Submit the application online. |

| 7. 📬 | Receive Registration Confirmation: – Wait for the registration process to be completed. – Once approved, receive a unique registration code, your Estonian Personal Identification Code (ID code). |

| 8. 🏦 | Collect e-Residency Card: – If not done already, collect your e-Residency card. |

| 9. 🚀 | Start Business Activities: – With your e-Residency card and ID code, legally conduct business activities in Estonia. – Open a business bank account if required, using your e-Residency card. |

| 10. 📅 | Annual Reporting and Compliance: – Ensure compliance with Estonian regulations and fulfill annual reporting requirements. – Renew your e-Residency card as needed. |

Register a company by Power of Attorney

| Step | Process |

| 1. 📄 | Prepare Power of Attorney: – Draft a Power of Attorney document, clearly specifying the authority granted to the appointed representative for company registration. |

| 2. ✅ | Notarize Power of Attorney: – Notarize the Power of Attorney document to ensure its legal validity. |

| 3. 🌐 | Make an Apostille Stamp (if needed): – Obtain an Apostille stamp for international authentication if required. |

| 4. 🏢 | Choose a Unique Company Name: – Decide on a unique name for your company adhering to Estonian business name regulations. |

| 5. 📄 | Prepare Documentation: – Gather identification documents for all shareholders and directors. – Draft articles of association outlining your business’s purpose and structure. |

| 6. 🖥️ | Register at the Notary Public: – Complete the registration process at the Notary Public office, presenting the Power of Attorney, Apostille stamp, and other necessary documents. |

| 7. 📤 | Submit Documents: – If required, upload scanned copies of identification documents and other necessary paperwork. – Submit the application online. |

| 8. 📬 | Receive Registration Confirmation: – Wait for the registration process to be completed. – Once approved, receive a unique registration code, your Estonian Personal Identification Code (ID code). |

| 9. 🏦 | Collect Corporate Documents: – Collect all corporate documents, including the registered Power of Attorney and any certificates issued during the registration process. |

| 10. 🚀 | Start Business Activities: – With the registered Power of Attorney and corporate documents, the appointed representative can legally conduct business activities in Estonia. |

E-Residency card vs Power of Attorney

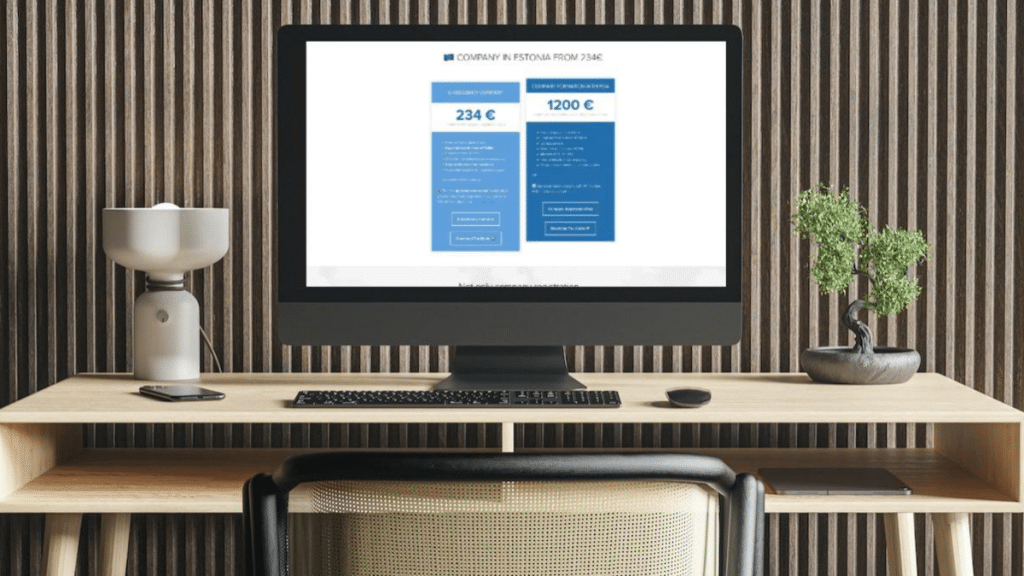

Let’s delve into a comprehensive comparison of company registration using the e-Residency card versus the Power of Attorney. This analysis is brought to you by Eesti Consulting, a fully experienced service provider from Estonia.

| Aspect | E-Residency | Power of Attorney |

| Cost | 💳 234 € + State fee (265€) | 💸 1200 € + State fee + Certified translation PoA + Notarial fees |

| Free Services | 🆓 Free company name check 🏢 Legal address in the heart of Tallinn 👤 Contact person service 📜 Free certificate of tax residency 📄 Corporate documents – scanned copies | 🆓 Free company name check 🏢 Legal address in the heart of Tallinn 👤 Contact person 📜 Free certificate of tax residency 📄 Corporate documents – scanned copies |

| Additional Fees | 💸 State fee not included (€265 from 1st January 21) | 💸 State fee not included (€265) + Attorney fees included |

| Time | 🕒 3 hours | 🕒 7-10 days |

| Paperwork | 📄 Paperless | 📄 Notarized and apostilled Power of Attorney |

| Management | 💼 With e-ID card | 🚫 Difficult management without card |

Legal Requirements and Documentation Needed for Company Formation

When establishing a company in Estonia, there are certain legal requirements and documentation that must be fulfilled. Firstly, all shareholders and directors must have valid identification documents such as passports or ID cards.

You’ll need to draft articles of association that contain information about the purpose of your business, its registered address, share capital details, and management structure.

Furthermore, it’s crucial to appoint at least one director who is an Estonian resident or has an Estonian e-residency card. The director will act as the main representative of the company and handle day-to-day operations.

In terms of documentation needed for company formation, you’ll require:

- Identification documents (passports or ID cards) for all shareholders and directors.

- Proof of home address – f.e utility bill not older than 3 months

- Filled KYC/AML form and the description of nature of business.

Timeframe for Establishing a Company in Estonia

The time it takes to establish a company in Estonia can vary depending on several factors. Generally, the process can be completed within a few days to a couple of weeks.

Registering your company with the Estonian Commercial Register usually takes around from 3 hours to 1-3 business days if you submit all the required documents correctly. However, it’s important to note that additional processing time may be required if any discrepancies or issues arise during the registration process.

Once your company is registered, you’ll receive your Estonian Company Number.

Costs of Company Registration in Estonia

In order to register a company in Estonia, it is important to understand the various fees involved. Let’s take a closer look at the government charges, notary fees, and other expenses associated with company registration in this European country.

Understand the various fees involved in registering a company in Estonia.

There are several costs that need to be considered. The first fee you will encounter is the registration fee, which is paid to the Estonian Commercial Register. This fee covers the administrative costs associated with processing your company registration application. You may need to pay for legal advice or consultation services if you require assistance with the registration process.

Learn about government charges, notary fees, and other expenses associated with registration.

Apart from the registration fee, there are other charges imposed by the Estonian government that you should be aware of. These include:

- State fee: This is another mandatory payment that needs to be made during the company formation process. The state fee varies depending on whether you are registering as a private limited company or a sole proprietorship.

- Notary fees: In Estonia, certain documents related to company formation need to be notarized. Notary fees can vary based on the complexity of the documentation and services provided by the notary.

- Accounting and bookkeeping costs: Every registered Estonian company is required by law to maintain accurate accounting records. You may choose to hire an accountant or use accounting software for this purpose. It’s essential to consider these ongoing costs when calculating your overall expenses.

- Virtual office services: If you do not have a physical presence in Estonia but still want an official address for your business, virtual office services can be utilized. These services provide you with an address for official correspondence and may incur additional costs.

Discover how these costs compare to other European countries.

When comparing the costs of company registration in Estonia to other European countries, it is important to consider the overall business environment and benefits offered. While the initial fees may vary, Estonia is known for its favorable business climate and digital infrastructure. Here are a few key points to consider:

- Lower registration fees: Estonia offers relatively lower registration fees compared to many other European countries.

- Efficient online processes: The Estonian government has implemented efficient online systems that streamline the company formation process, reducing administrative burden and potentially saving costs.

- Tax benefits: Estonia has an attractive tax system, including a 0% corporate income tax on retained earnings. This can be advantageous for businesses in terms of long-term savings.

Running Costs for an E-Resident Business in Estonia

Running a business in Estonia as an e-resident comes with ongoing expenses that need to be considered.

Taxes

One of the key financial obligations for any business is taxes. As an e-resident business owner in Estonia, you will be subject to certain taxes that contribute to the running costs. Here are some important tax considerations:

- Corporate Income Tax: Estonian companies are subject to a flat rate of 20% corporate income tax on distributed profits. However, if the profits are reinvested or retained within the company, no immediate tax liability arises.

- Value Added Tax (VAT): If your business engages in taxable activities such as selling goods or providing services, you may need to register for VAT and collect it from your customers. The standard VAT rate in Estonia is 20%. Did you reach the VAT threshold? – Do VAT Registration in Estonia.

Understanding these tax obligations is crucial for budgeting purposes and ensuring compliance with Estonian tax laws.

Accounting Services

Maintaining proper accounting services in Estonia is essential for any business, including e-resident businesses in Estonia. While you have the option to handle accounting tasks yourself, many businesses choose to outsource this responsibility to professional accounting service providers. Here’s why:

- Expertise: Professional accountants have knowledge and expertise in handling financial matters specific to Estonian regulations.

- Time-Saving: Outsourcing accounting tasks allows you to focus on core business activities instead of spending time on complex financial recordkeeping.

- Compliance: Professional accountants ensure that your financial records comply with Estonian legal requirements.

While outsourcing accounting services incurs additional costs, it can provide peace of mind knowing that your financial records are accurate and compliant.

Other Financial Obligations

Apart from taxes and accounting services, there are a few other financial obligations that e-resident businesses in Estonia should be aware of. These include:

- State Fee: As an e-resident business, you are required to pay an annual state fee for the maintenance of your company in the Estonian Business Register. The current state fee is 145 euros per year.

- Banking Costs: Opening and maintaining a business bank account in Estonia may involve certain fees, such as monthly account maintenance fees or transaction fees. It’s important to consider these costs when budgeting for your business.

Impact on Overall Budget

When starting and running a business, it’s crucial to have a clear understanding of all the costs involved.

Options for Registering a Company in Estonia

In Estonia, there are different ways to register a company depending on your needs and circumstances. Let’s explore these options and discuss the advantages and disadvantages of each.

E-Residency

Estonia offers an innovative program called e-residency, which allows individuals from anywhere in the world to establish and manage their business remotely. With e-residency, you can register a company online without physically being present in Estonia.

Advantages

- Convenience: E-residency eliminates the need for travel or relocation, making it ideal for digital nomads or entrepreneurs who prefer to work remotely.

- Global Reach: By registering as an e-resident, you gain access to the European Union (EU) market and can operate your business within the EU.

- Digital Services: E-residents have access to various digital services provided by the Estonian government, including online banking, taxation, and legal services.

Disadvantages

- Limited Physical Presence: While e-residency allows you to run your business remotely, it may lack personal interaction with clients or partners that some businesses require.

- Increased Competition: As more people discover the benefits of e-residency in Estonia, competition among businesses may intensify.

- Language Barrier: Although many Estonians speak English fluently, there might still be language barriers when dealing with local authorities or clients.

Local Representation

If you prefer a more traditional approach to company registration in Estonia, you can opt for local representation. This involves appointing a local representative who will handle administrative tasks on behalf of your company.

Advantages

- Local Expertise: Having a local representative ensures that someone familiar with Estonian laws and regulations is managing your company’s affairs.

- Personal Interaction: A local representative can facilitate face-to-face meetings with clients or partners if necessary.

- Language Assistance: Your local representative can help bridge any language gaps that may arise during business transactions.

Disadvantages

- Additional Costs: Hiring a local representative may incur additional expenses, such as salary or service fees.

- Dependency on Others: Relying on a local representative means relinquishing some control over your company’s day-to-day operations.

- Limited Flexibility: If you prefer to have direct control and make decisions independently, local representation may not be the best option for you.

Commercial Register

Another way to register a company in Estonia is through the Commercial Register. This method requires physically visiting Estonia and completing the registration process in person.

Advantages

- Direct Involvement: Registering your company through the Commercial Register allows you to actively participate in every step of the process.

Additional Services for Company Formation in Estonia

There are additional services offered by service providers that can simplify the company formation process. These services aim to streamline your journey towards establishing a business and provide you with the necessary support and assistance along the way. Let’s explore some of the key additional services available:

Virtual Office Solutions

A virtual office solution is an excellent option for those who do not require a physical office space but still need a professional business address. Service providers offer virtual office solutions that allow you to use their prestigious business address as your own. This can be beneficial for companies operating remotely or those looking to establish an online presence while maintaining a professional image.

Pros:

- Provides a professional business address without the need for physical office space.

- Enhances credibility and trustworthiness in the eyes of clients and partners.

- Offers mail handling services, including mail forwarding or scanning.

Cons:

- May incur additional costs depending on the service provider.

- Limited access to physical meeting rooms or facilities.

Banking Assistance

Setting up a corporate bank account is an essential step when forming a company. Many service providers offer banking assistance to help you navigate through this process smoothly. They can guide you in choosing the right bank and assist with preparing all the necessary documentation required for opening a corporate bank account.

Pros:

- Simplifies the process of opening a corporate bank account.

- Provides guidance on selecting banks that align with your business needs.

- Assists with paperwork, ensuring compliance with banking regulations.

Cons:

- Some banks may have specific requirements or restrictions based on your company type or industry.

- Additional fees may apply depending on the chosen banking services.

Legal Support

Navigating legal matters during company formation can be complex, especially if you are unfamiliar with local laws and regulations. Service providers often offer legal support to ensure that all legal requirements are met and that your company is compliant with Estonian laws. They can assist in drafting legal documents, such as articles of association, shareholder agreements, and employment contracts.

Pros:

- Provides professional legal guidance throughout the company formation process.

- Ensures compliance with Estonian laws and regulations.

- Assists in drafting important legal documents.

Cons:

- Legal support services may come at an additional cost.

- It’s essential to choose a reputable service provider with expertise in Estonian law.

By utilizing these additional services, you can simplify the company formation process and focus on building your business. Whether it’s obtaining a virtual office address for a professional image or receiving assistance with banking or legal matters, these services cater to various needs and requirements.

Types of Partnerships in Estonia

In Estonia, entrepreneurs have several options. Each partnership structure has its own characteristics and legal requirements, so it’s important to understand them before making a decision. Let’s explore the different types of partnerships available for entrepreneurs in Estonia and determine which one aligns with your business goals.

General Partnership

A general partnership is the simplest form of partnership in Estonia. In this type of partnership, two or more individuals come together to run a business and share profits and losses equally. The partners have unlimited liability, meaning they are personally responsible for any debts or obligations of the partnership.

Pros:

- Easy to set up and maintain.

- Shared decision-making among partners.

- Flexibility in profit distribution.

Cons:

- Unlimited liability puts personal assets at risk.

- Potential conflicts between partners.

- Difficulty in raising capital compared to other partnership structures.

Limited Partnership

A limited partnership consists of at least one general partner and one or more limited partners. The general partner manages the day-to-day operations and has unlimited liability, while the limited partners contribute capital but have limited liability. Limited partners are not involved in the management of the business.

Pros:

- Limited partners have protection from personal liability.

- General partner has control over business operations.

- Easier access to capital due to involvement of limited partners.

Cons:

- General partner assumes full responsibility for debts and obligations.

- Limited partners have restricted involvement in decision-making.

- More complex legal requirements compared to a general partnership.

Public Limited Company (PLC)

A public limited company, also known as an “aktsiaselts” (AS) in Estonia, is a separate legal entity that can issue shares publicly. It requires at least one shareholder and a management board responsible for running the company’s affairs. A PLC must meet specific regulatory requirements and is subject to greater scrutiny than other types of partnerships.

Pros:

- Limited liability for shareholders.

- Ability to raise capital by issuing shares publicly.

- Enhanced credibility and reputation in the market.

Cons:

- More complex legal and reporting obligations.

- Higher costs associated with registration and compliance.

- Greater public scrutiny and transparency requirements.

Private Limited Company (LLC)

A private limited company, also known as an “osaühing” (OÜ) in Estonia, is a popular choice for entrepreneurs. It requires at least one shareholder, who can also be the director of the company. An LLC offers limited liability to its shareholders and has fewer regulatory requirements compared to a PLC.

Pros:

- Limited liability protection for shareholders.

- Flexibility in ownership structure and profit distribution.

- Easier transfer of ownership through share transfers.

Pricing Details and Inclusions for Estonian Company Formation

To successfully form a company in Estonia, it is essential to understand the pricing details and what is included in the packages offered by service providers. This section will provide you with a comprehensive overview of the pricing packages available, the services they encompass, and how to compare them to find the one that suits your budget and requirements.

Detailed Information on Pricing Packages

When considering company formation in Estonia, it’s crucial to gather detailed information about the pricing packages provided by different service providers. These packages vary in terms of cost and services offered. By comparing them, you can make an informed decision that aligns with your needs.

Here are some key points to consider when evaluating pricing packages:

- Cost Breakdown: Examine the breakdown of costs within each package. This will give you a clear understanding of where your money is being allocated and help you determine if it fits within your budget.

- Service Inclusions: Take note of what services are included in each package. Common inclusions may involve legal assistance, document preparation, registration fees, virtual office services, or even assistance with opening a bank account.

- Additional Services: Some service providers offer additional services that may be beneficial for your business. These could include tax advice, bookkeeping support, or ongoing compliance assistance. Consider whether these extras are necessary for your specific requirements.

- Customization Options: Explore whether there are any customization options available within each package. Being able to tailor certain aspects can help ensure that you receive precisely what you need without paying for unnecessary features.

- Customer Support: Evaluate the level of customer support provided by each service provider. Having reliable support throughout the process can be invaluable if any issues or questions arise along the way.

Conclusion

Congratulations on completing the journey through the world of company formation in Estonia! You’ve gained valuable insights into the costs, options, and requirements for setting up your own business in this innovative country. Now that you have a clear picture of what it takes to register a company in Estonia, it’s time to take action and turn your entrepreneurial dreams into reality.

But before you embark on this exciting adventure, remember to consider all aspects of running a business in Estonia. From the initial registration costs to the ongoing expenses, make sure you have a solid plan in place. Take advantage of additional services available for company formation to simplify the process and ensure compliance with local regulations.

Estonia offers an attractive environment for entrepreneurs like yourself, with its e-residency program and digital infrastructure. So why wait? Start exploring the possibilities today and pave your way towards success. Remember, every great journey begins with a single step – take that step now and unlock the potential of starting your own company in Estonia!

Ready to bring your business ideas to life? Contact us today and let our team of experts guide you through the process of company formation in Estonia.

Angela Spearman is a journalist at EzineMark who enjoys writing about the latest trending technology and business news.